AI is in full swing and coming into many fields and everyday life. Credit repair is no different. Artificial intelligence credit repair software is a new and emerging field that has shown some great ways to help people clean up their credit and deal with credit issues. In this article, we will discuss AI credit repair software, how it works, and the best tools to use this year.

What is AI Credit Repair Software and How Does it Work?

Understanding AI Technology in Credit Repair

AI credit repair software is a tool that uses artificial intelligence to help repair your credit. It works by analyzing your credit report and identifying negative items. The software then creates a plan to dispute these items with the credit bureaus. Some of these tools come with customer service representatives to help you through the process. Many come with a step-by-step system to take care of the work.

How AI Credit Repair Software Personalizes Your Experience

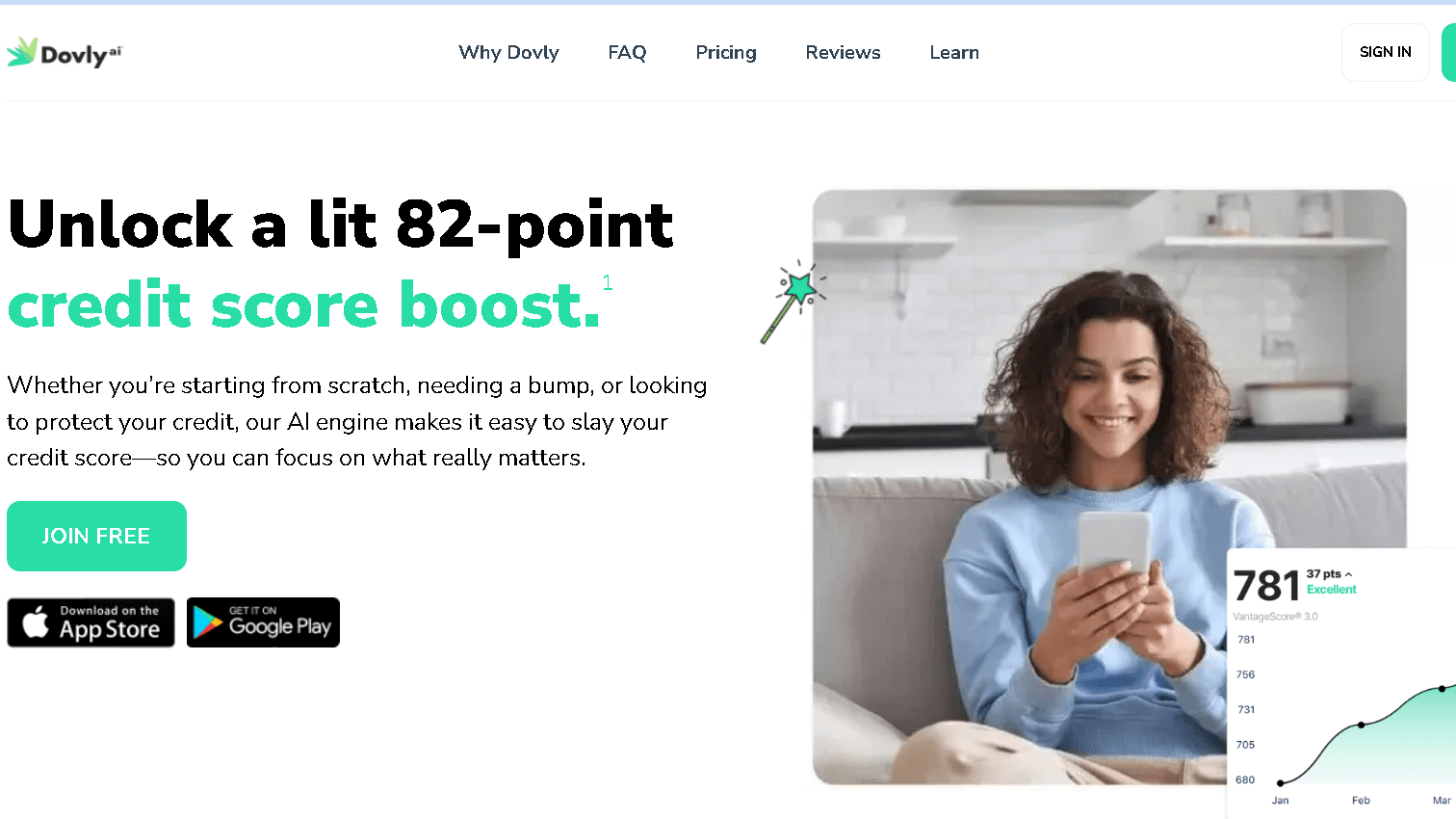

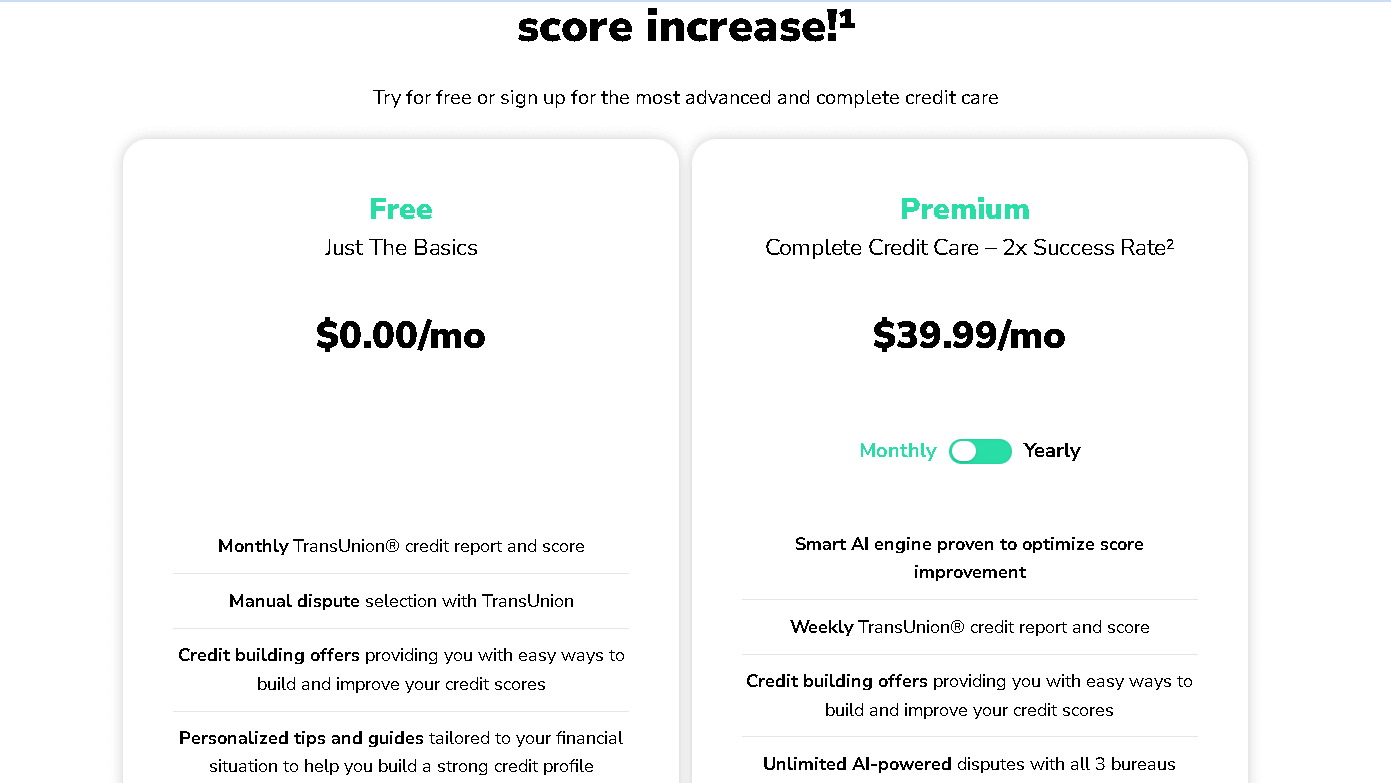

The leading AI credit repair software customizes user experience. Dovly AI, for example, personalizes its service according to the unique credit profile of an individual. This allows users to get recommendations that are specifically tailored to their personal credit situation. By analyzing individual credit reports, AI provides insights that are directly relevant to a user’s specific credit challenges. This level of personalization ensures that the credit repair tools can be utilized by anyone looking to improve their credit score.

Key Features of the Best AI Credit Repair Tools

Top credit repair software solutions have several features that help users repair their credit. Some of the most popular features include automated dispute assistance, real-time credit monitoring, and credit analysis. Dispute AI is a significant feature; this function automatically creates dispute letters for any errors that it uncovers. In addition, many AI-based credit repair solutions come with educational content. These resources help users learn about their credit scores and the elements that impact them.

How Can You Improve Your Credit Score with AI Credit Repair Software?

Using AI to Identify Negative Items on Your Credit Report

The first step in the credit repair process is identifying negative items on your credit report. AI credit repair software can automatically scan and analyze credit reports to identify errors, such as late payments, accounts in collections, or accounts not reported accurately. It can also identify patterns and discrepancies that the user may miss and ensure that all inaccurate information is included in the dispute process.

The Dispute Process: How AI Can Help You

AI Credit Repair Software The dispute process can be intimidating, but AI credit repair software is here to help. Credit repair tools like Dovly AI automate dispute letter writing and send directly to the credit bureaus like TransUnion. This not only helps get a faster response, but can also improve your odds of getting the false information removed from your credit report. By making it easier to handle disputes, AI credit tools give you the power to take control of your credit.

Effective DIY Credit Repair Strategies for Better Scores

AI Tools can assist DIY Credit Repair Users in Developing Better Credit Scores. The software provides insights into factors impacting credit scores and helps users develop actionable plans to improve them. These plans may involve strategies like paying off outstanding debts, maintaining low credit utilization, and ensuring on-time payments. Users can track their progress with AI technology and adjust their strategies as needed.

What are the Top Picks for Credit Repair Software?

Overview of the Best AI Credit Repair Solutions

Some examples of AI credit repair tools that people have mentioned as being particularly helpful are Dovly AI, which is a popular credit repair platform that uses artificial intelligence to automate and simplify the process of repairing credit, and Credit Versio, which is a platform that offers credit repair tools and resources to help users better understand their credit and repair their credit history. These AI-powered credit repair tools offer a range of features that make the credit repair process more accessible and efficient, such as the ability to analyze credit reports and generate dispute letters automatically. They have been praised by users as being effective and user-friendly, and have become popular options for those looking for a more efficient way to repair their credit.

Comparing Dovly AI with Other Credit Repair Companies

Dovly AI compared to other Credit Repair Companies

Dovly AI stands out from the crowd by offering AI-powered, customized recommendations. This feature makes it one of the top choices among AI credit repair tools. Unlike many other credit repair companies that might adopt a one-size-fits-all approach, Dovly is designed to cater to the unique needs of each individual’s credit situation. This level of personalization is crucial in the credit repair industry, where a tailored strategy can significantly impact the success of improving one’s credit score.

Unique Features of the Best Credit Repair Software

AI credit repair software tends to have a few features in common, which contribute to its effectiveness and user-friendliness. Automated dispute generation and submission is a standard feature. Real-time credit monitoring and alerts allow users to track changes to their credit reports instantly. Many AI credit repair tools also offer credit education resources to help users better understand credit.

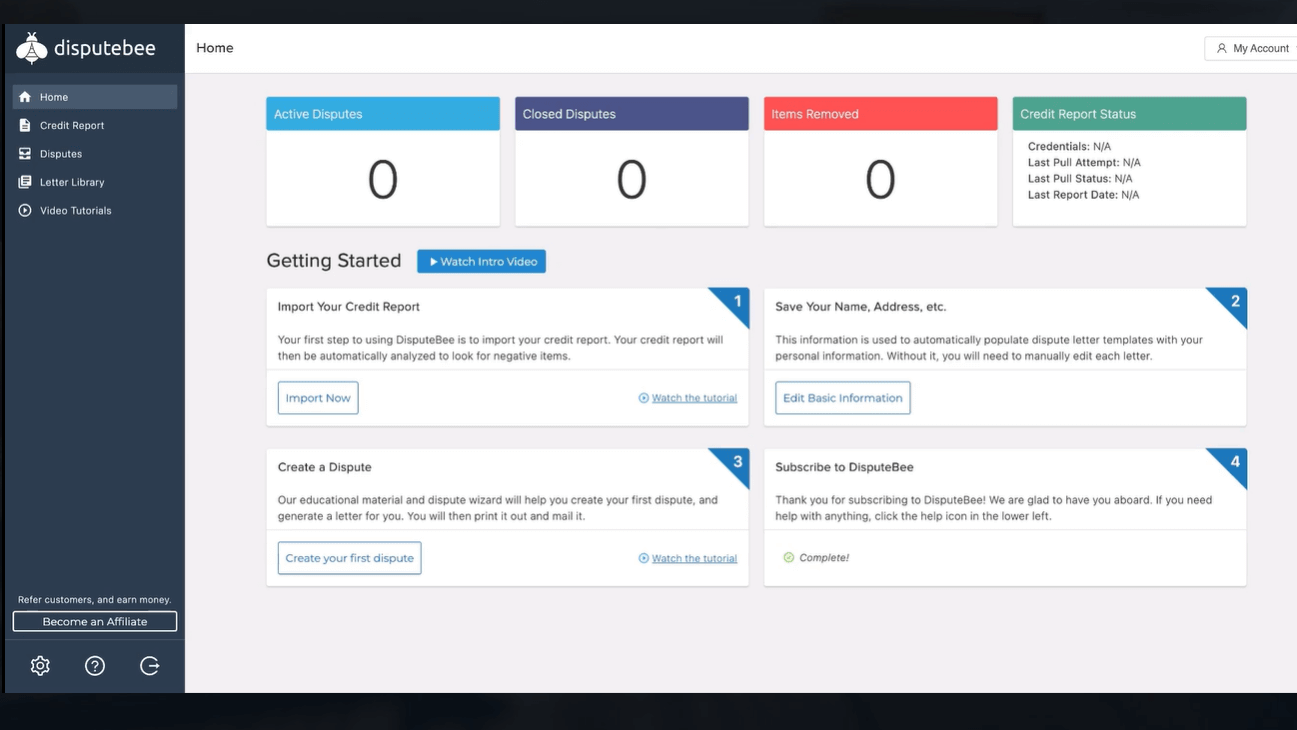

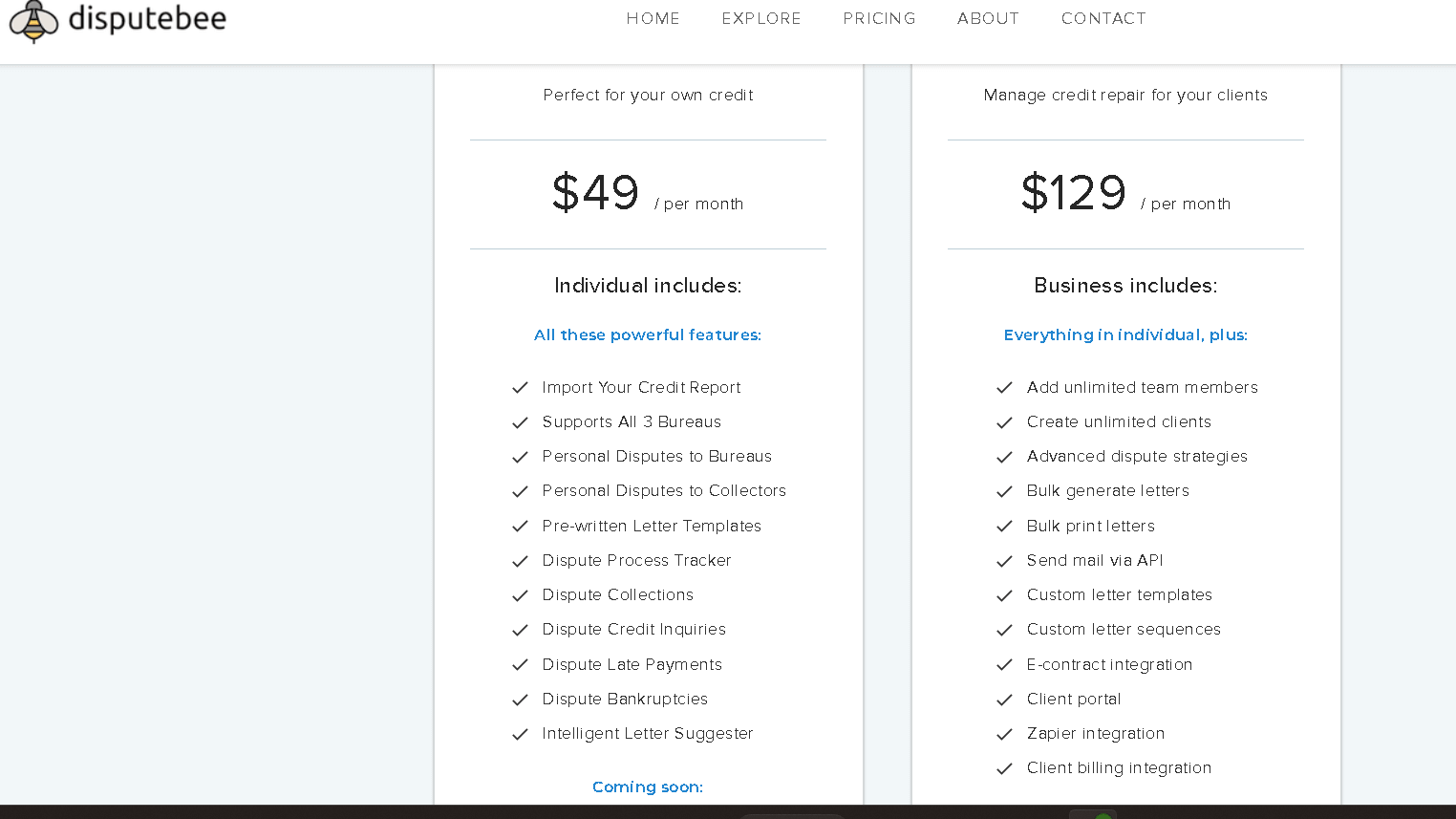

Dispute Bee Credit Repair Software

The service also provides a dispute software package with dispute letter generation and dispute tracking features. DisputeBee is very appealing for both the individual and credit repair companies due to its speedy process. If you have several items to dispute, this software might be worth your investment. If, on the other hand, you only have a few accounts to dispute, DisputeBee may be overkill, and too costly.

CreditVersio

Credit Versio is not a typical credit repair company. Instead of using an automated credit analysis program, it’s an AI (artificial intelligence) program that provides you with a credit score tailored just for you, while keeping you on track by monitoring your progress and making alternate recommendations if you don’t quite meet your expectations.

Credit Versio is a service that can assist you in increasing your credit score. You can use their online dispute letter service if you have a credit bureau membership, and they’ll even cover the postage.

Credit Versio has not been the beneficiary of a large volume of independent reviews from regulators such as the CFPB, and it hasn’t taken long for that fact to become readily apparent. In addition, customer reviews are not plentiful on many of the more mainstream sites other than trustpilot.com. There is a lot of information there though and the bulk of it is positive. Overall customers have been quite happy with the service they have received from Credit Versio and they have earned an excellent TrustScore of 4.4 stars out of 5.

How Do Credit Repair Services Help You Manage Your Credit?

Benefits of Using Credit Repair Services for Financial Freedom

AI-powered credit repair services are beneficial in many ways and using them can get you closer to the financial freedom you’ve always wanted. The use of the free credit repair services allows you to take back control of your credit and qualify for the loans and interest rates you want to have. The more you use these apps, the more opportunities you unlock for yourself and as your credit health increases, your entire life starts to look and feel different. You’ll now be able to do things such as getting the insurance premiums you want or living in the house of your dreams. As you continue improving your credit score, financial freedom is what makes people want to achieve better results.

How Members Raise Their Scores Using AI Technology

Users of AI-powered credit repair services can often experience improvements in their credit scores. These systems can help members to dispute errors on their credit reports faster, due to the powerful detection of AI technology. The personalized insights of AI tools also help users to take action with their credit. Members can monitor their progress using the software and can celebrate their wins as they work with AI.

The Role of Credit Repair Businesses in Credit Improvement

Credit repair businesses are essential for the following reasons. They can help people understand the process of disputing inaccurate information and maintaining good credit. Learning more about how credit works can help users form positive financial habits, which are a key part of credit success in the future. Artificial intelligence tools are also used in credit repair companies to find more effective solutions for their customers.

Is DIY Credit Repair Effective with AI Tools?

Steps to Take Control of Your Credit Using AI

Repairing your credit on your own can be a successful strategy, especially when you have access to AI credit repair software to assist you. To begin, you should obtain a copy of your credit report and carefully review it using the AI credit repair tool. This will allow you to spot any errors or negative items that may be affecting your credit score. You can then use the dispute AI feature to generate and send dispute letters to the appropriate credit bureaus. By following these steps, you can take control of your credit and work towards repairing it.

Common Challenges in DIY Credit Repair and How to Overcome Them

DIY credit repair can be very successful, but there are some common challenges you should be aware of. It can be difficult to navigate the dispute process and you may face resistance from creditors or credit bureaus. To help you avoid these challenges, AI credit repair software can help automate many of the tasks involved in credit repair. It can also help you to educate yourself on your rights under the Fair Credit Reporting Act.

Success Stories: Improved Credit Scores Through DIY Methods

Innumerable people have managed to enhance their credit scores with the help of DIY credit repair techniques, with AI playing a significant role. A lot of users have shared their triumphant stories about how they achieved substantial credit score improvements by leveraging the capabilities of AI. These success stories frequently detail how users, with the assistance of AI, identified errors and discrepancies on their credit reports and effectively disputed them to receive the corresponding upgrades to their scores. These success stories not only validate the effectiveness of these AI tools but also inspire and empower others to take control of their credit situations. As the community of satisfied DIY credit repairers continues to expand, more individuals are likely to be inspired to embark on their own credit score journeys, contributing to the widespread adoption and success of AI-powered credit repair software.

Dovly has assisted over 500,000 Americans in managing their credit scores and attaining financial independence.

Dovly has helped more than 500,000 consumers in the United States of America take charge of their credit scores and achieve financial freedom. The credit repair software makes use of revolutionary ai credit engine. This means that the software is user friendly and can be used by anyone. Millions of Americans can use these services to get healthier financially.

The app is simply awesome as it helps to track where you are at with your credit. It also helps with information on your credit report and how to dispute and get rid of the bad items. I have found that the best Dovly Reviews work with me to help me raise my credit scores. With the help of premium plan’s Dovly creditrepair option, you can take charge of your financial life, the best new A.I. technology creates a customized plan just for you so you always have the best resources at your fingertips when it comes to your credit and need to raise your scores.

Features such as dispute resolution and diycreditrepair, Dovly helps you dispute credit report mistakes that lower your scores. By using the A.I. that creates a customized plan especially for you. You also save a lot of time and energy. In addition, the Dovly AI also has another unique method.

This is by using the 3 bureaus to make sure you are well covered. This simply means that the company uses an algorithm which makes it easy to repair your credit. For instance, it helps you to print or mail any important document. I have also found that they are in business to help their members, so financial independence is not far-fetched with Dovly.

I hope that I have given you useful information and that you have learned something new!

FAQs

Q: What is the best AI credit repair software?

A: Some of the best AI credit repair software are: MagicCredit – The Best Credit Repair Software of 2023, Credit Repair Assistant, Credit Repair Black Box, National Debt Relief, and Credit Repair Boost.

Q: How does artificial intelligence work to improve credit repair?

A: Artificial intelligence can improve credit repair by working tirelessly to analyze credit reports. This helps users to take control of their credit by quickly identifying credit errors and taking corrective action. Credit Repair Assistant is the best and a smart AI that helps take back control of credit.

Q: Can everyone use AI credit repair software?

A: Yes. Several companies have credit repair software that a person can use to repair their credit. Some of them include Credit Repair Software Programs, Credit Repair Software Reviews, Credit Repair Software Company, Credit Repair Software Application, and Credit Repair Software Cost.

Q: How can a person take advantage of credit repair software free trial?

A: Signing up for a free trial of credit repair software is fairly easy. A user only needs to do it from the credit repair solutions website by providing their information and sometimes credit report and they are good to go with no strings attached.

Q: How do I find the best new AI credit repair software?

A: A user can find the best new AI credit repair software by checking features like credit report analyzer, can help find mistakes in a credit report, and offers support for major bureaus such as Equifax, also, support for chat, and email.

Q: What are some companies that do credit solutions and utilize AI?

A: Credit solution companies are a lot, some of them use AI and some don’t. However, credit solutions companies that use AI for credit repair include Credit Repair Solution, Credit Solutions, Credit Solutions Black Box, Credit Solutions Relief, Credit Solution Service, and Credit Solutions Pro.

Q: How can I make sure that my credit history is corrected by using an AI credit repair software?

A: Credit repair software can ensure that a user’s credit history is corrected. It is usually done by the credit software by analyzing a credit report for any inaccuracy, and by providing a user with a step-by-step actionable plan of events that must be followed to ensure that a credit history is correct. Credit repair companies and repair software that can do this include Credit Repair Assistant, Credit Repair Pro, Credit Repair Black Box, National Debt Relief, and Credit Repair Boost.

Q: What role do the featured blogs play in credit repair?

A: Featured blogs give reviews, comparisons, and other information on the best credit repair tools that can help a user to choose the most appropriate one. For the best AI credit repair software, it’s worth checking their blogs section for featured blogs.

Q: Can I learn how to use credit repair software from TikTok?

A: Yes, TikTok is a great place for learning and discovering, some people share their experiences and reviews of credit repair software as well as how they have used it to improve their credit.